Explain Different Functions of Commercial Banks

Commercial banking is the most significant portion of modern banking system. Individuals and companies can deposit money with a bank by opening an account.

Central Bank Vs Commercial Bank Difference And Comparison The Investors Book

Banks provide safety vaults and lockers to their customers for safe custody of their valuable articles and documents.

. Credit creation done by banks is the basis of economic development of a modern capitalist society. Time deposits The bank accepts deposits for a. Under this scheme a safe is supplied to the depositor to keep it at home and to put his small savings in it.

They are Collecting dividends in the name of customers. They render many valuable services. Notes on Commercial Banks and Credit Creation Short notes on Manner of Raising Deposits in.

It is the most important function of commercial banks when a bank provides loan to customer it does not provide cash but instead it opens deposit account where the. Commercial bank accepts deposits from the public in the following forms. Banks lend money for industrial commercial and other purposes.

Some of the functions are mentioned below. Banks also issue letters of credit like circular notes and travellers cheque etc to. IvBanks help in allocation of funds.

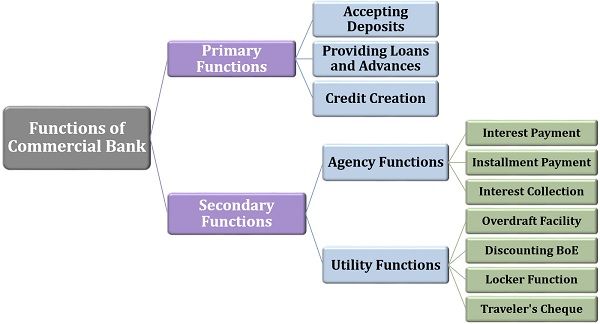

Raising capital gains in the name of customers. Commercial banks generally confine themselves to short-term lending against readily realisable securities like gold government promissory notes bills of exchange. Primary and Secondary Functions of Commercial Banks.

Along with that it provides a range of financial services to the general public such as accepting deposits granting loans and advances to the customers. What are the Functions of Commercial Bank1 Accepting DepositsBanks accept deposits in several forms likei Current Account Demand DepositsThese are the deposits that are repayable by bank on demandThey can be withdrawn by chequeThey do not have an interest rateii Time Fixed DepositsThese are t. A commercial bank performs two primary functions.

Functions of Commercial Banks. According to Culbertson Commercial Banks are the institutions that make short make short term bans to business and in the process create money. The bankthe building people processes and servicesis a mechanism for drawing in more capital.

They borrow in the form of deposits and lend in various types of advances. Top 5 Functions Performed by Commercial Banks Discussed. By providing funds and helping in the payment and transfer of money.

Buying and selling bonds. IiiBanks promote trade especially foreign trade. The main functions of the commercial banks can be summed up in one sentence.

It is necessary to understand the different types of financial institutions to explain the. Perhaps the most common feature of a bank is saving your money. Loans may be given in a variety of ways viz cash credit overdraft facilities and the discounting of commercial papers like bills of exchange hundis etc.

Commercial banks accept deposits from people businesses and other entities in the form of. Explore their economic role and the different functions involved in. I Current Account Deposits.

The deposits may be of three types. They accept deposits in several forms according to requirements of different sections of the society. Commercial banks provide loans and advances like overdraft facility bill discounting etc.

Periodically the safe is taken to the bank where the amount of safe is credited to his account. The two primary characteristics of a commercial bank. These are provided against the proper security.

In this way banks help depositors to come to banks and help in. An individual can open a savings account in a commercial bank. The important functions of the Commercial banks can be explained with the help of the following chart.

To receive deposits and to advance loans are thus the two main functions of all commercial banks. Agency Services of the Bank. The main kinds of deposits are.

Banks mobilize peoples savings by offering interest on the deposits. The banks borrow to lend. Commercial banks offer a wide range of services and functions to their respective clients.

Saving deposits Current deposits and. The functions of commercial banks are primarily based on a business model of accepting public deposits and utilizing that fund for various investment purposes. The various investment services provided by commercial banks are called agent services.

A commercial bank is basically a collection of investment capital in search of a good return. Such 10 functions are described below. A commercial bank is a kind of financial institution that carries all the operations related to deposit and withdrawal of money for the general public providing loans for investment and other such activities.

The commercial banks serve as the king pin of the financial system of the country. The function of commercial bank can be divided into three categories. A commercial bank is a profit-based financial institution that grants loans accepts deposits and offers other financial services such as overdraft facilities and electronic transfer of funds.

These banks are profit-making institutions and do business only to make a profit. Such functions can be classified into two categories primary and secondary functions. Commercial banks accept deposits from the public who have surplus funds.

Commercial Bank can be described as a financial institution that offers basic investment products like a savings account current account etc to the individuals and corporates. Primary Functions of Commercial Banks. Banks are the carriers of the vehicle of economic development.

It is the most important function of commercial banks. The most significant and traditional function of commercial bank is accepting deposits from the public. Functions of Commercial Banks.

The most important functions of commercial banks are discussed below. Savings deposits The commercial bank accepts small deposits from households or persons in order to encourage savings in the economy. The second important function of a.

Dealing with applications for issuance of new business shares. B Fixed deposit account. Commercial banks are legally authorized institutions that lend money to and receive money from individuals and businesses alike.

Commercial Banks It S Functions And Types Explained

Comments

Post a Comment